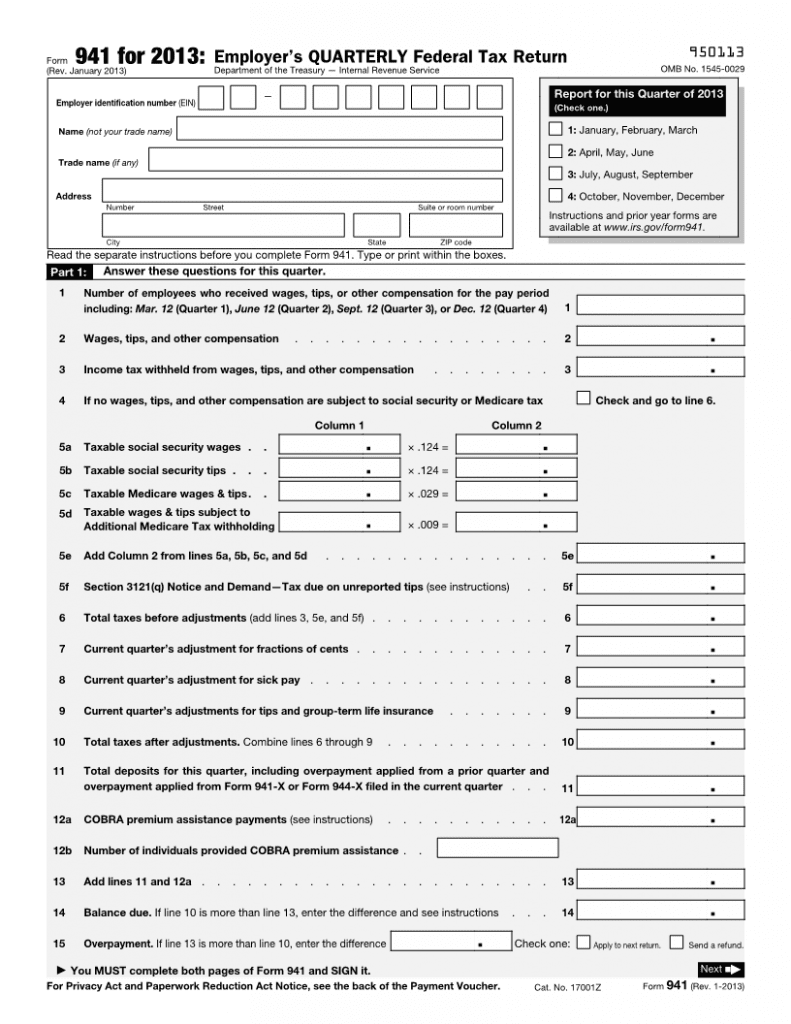

A form used by employers who hold back a certain portion of the salary of the employees for various taxes such as income tax, to file quarterly federal tax returns have to fill this form and submit it to the Department of Treasury – IRS (Internal Revenue Service).

[easy_ad_inject_1]

The form should have the EIN (employer identification number), full and legal name (first, middle, last) & complete address with the city, state and zip code followed by choosing which quarter of the present year you are reporting for.

The form is divided in five parts, wherein the first part includes a set of questions like; number of employees who received any kind of wages, compensation, etc., during the whole financial year, wages / tips & other compensations, income tax that is held back, check the current box and go to point ‘six’ if there are no wages, tips or compensations related to social security or Medicare tax or continue, fill in the taxable social security wages / tips / Medicare wages or tips / Additional Medicare Tax withholding in the “column 1 and column 2” as given, add the required figures for the points 5e, 5f & 6th, current quarters adjustments for fractions of cents, sick pay & tips and group-term life insurance needs to be given for points 7, 8 & 9 followed by the total of points 6 to 9 needs to be stated at point 10, total deposits for this quarter, ‘COBRA’ premium assistance payments followed by the number of individuals provided premium assistance along with the total of point 11 & 12a, balance due and over-payment.

In the next page and part two, state your name and EIN # and then explain the deposit schedule and tax liability for this quarter by choosing one of the options followed by the part three where type of business needs to be chosen.

In the fourth and the fifth part of the form choose if you allow to designate a third party to speak to the IRS about this return and lastly sign the document followed by your full name, title and daytime phone number.

At the end of the document detach it where it says to do so and fill the receipt and send it to the aforementioned department.

Employer’s Quarterly Federal Tax Return Form 941

Form Preview