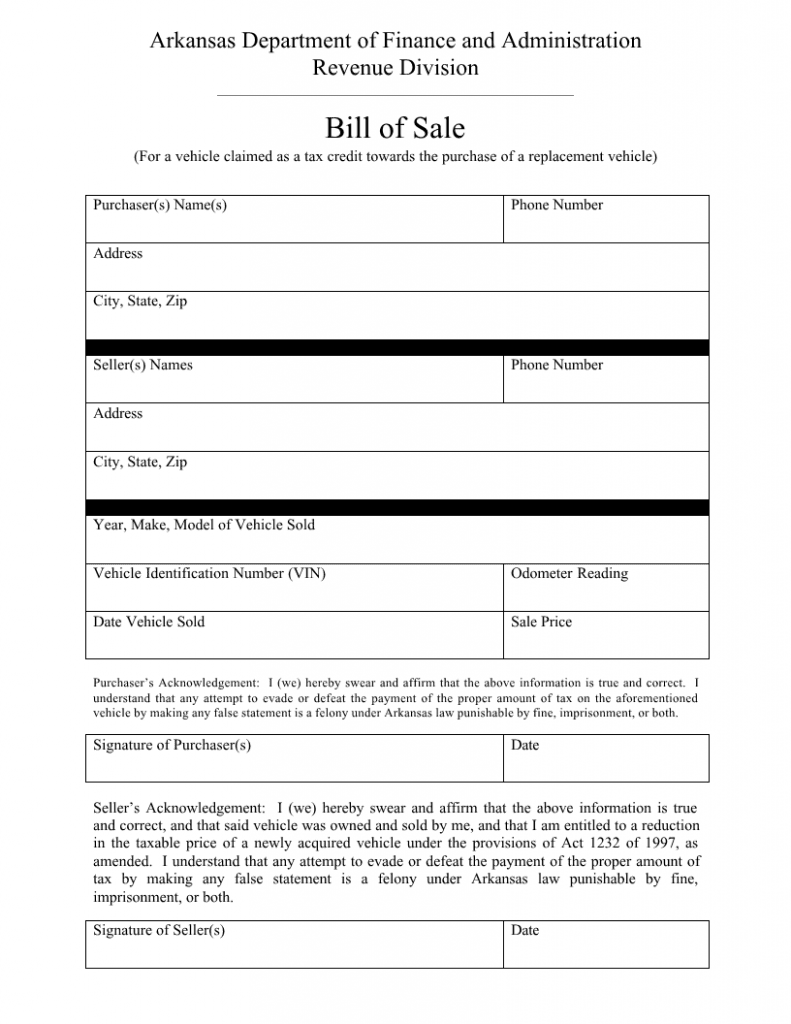

The Arkansas Tax Credit Vehicle Bill of Sale form is one which is used for the sole purpose of allowing the seller of the motor vehicle 45 days before or after the purchase of the vehicle to purchase a replacement vehicle. By doing so, he/she will only have to pay a tax on the selling price difference between the two vehicles, as per Act 1232 of 1997.

Once this form has been filled out, it must be signed and submitted to the Arkansas Department of Finance and Administration Revenue Division; this form is only valid within the state of Arkansas.

Guide to Fill the Arkansas Tax Credit Vehicle Bill of Sale

- Begin my entering the details of the purchaser(s). This includes legal name of the purchaser, his/her phone number, address in full as well as city, state and zip code.

- Next, the same details of the seller(s) is needed – full legal name, phone number, detailed address, state, city and zip code. Remember to mention all names if there are multiple buyers or sellers.

- Now, details of the vehicle being sold are required. These include year of manufacture of the vehicle sold, make and model of the vehicle, VIN (Vehicle Identification Number), reading on the odometer when sold, date of sale and the exact sale price.

To conclude the form, acknowledgments from the seller and buyer are required. The purchaser first acknowledges that the above information is true and accurate and that any attempt to evade taxes is a felony under Arkansas State Law. Signature of the purchaser(s) is required along with the date.

Next, the seller acknowledges that the above information is true and correct and that the vehicle was sold by him/her. Also, that any attempt to evade taxes is a felony under Arkansas State Law. The seller(s) signature(s) along with the date of signature is needed and the form is complete.

Free Download Link

Arkansas Tax Credit Vehicle Bill of Sale

Form Preview